Yadda ake lissafin harajin Australiya da GST lokacin da kuke shigo da su daga China zuwa Ostiraliya?

Yadda ake lissafin harajin Australiya da GST lokacin da kuke shigo da su daga China zuwa Ostiraliya?

Ana biyan harajin Australiya / GST ga kwastam na AU ko gwamnati waɗanda za su ba da daftari bayan kun ba da izinin kwastam na Australiya

Wajibcin haraji/GST na Australiya ya ƙunshi sassa uku waɗanda su ne DUTY, GST da CHARGE SHIGA.

1.Duty ya dogara da irin nau'in samfurori.

Amma kamar yadda kasar Sin ta rattaba hannu kan yarjejeniyar ciniki cikin 'yanci tare da Ostiraliya, idan za ku iya ba da takardar shaidar FTA, fiye da kashi 90% na kayayyakin da Sin ke samu ba su da haraji. Ana kuma kiran takardar shaidar FTA takardar shaidar COO kuma ana amfani da ita don nuna cewa ana yin samfuran a China.

2.GST shine kashi na biyu da kuke buƙatar biya ga kwastam na AU lokacin da kuke shigo da kaya daga China.

GST shine 10% na ƙimar kaya wanda ke da sauƙin fahimta

3.Kudin shiga shi ne kashi na uku da hukumar kwastam ta AU za ta karba kuma ana kiranta da sauran cajin. Yana da alaƙa da ƙimar kaya wanda yawanci daga AUD50 zuwa AUD300.

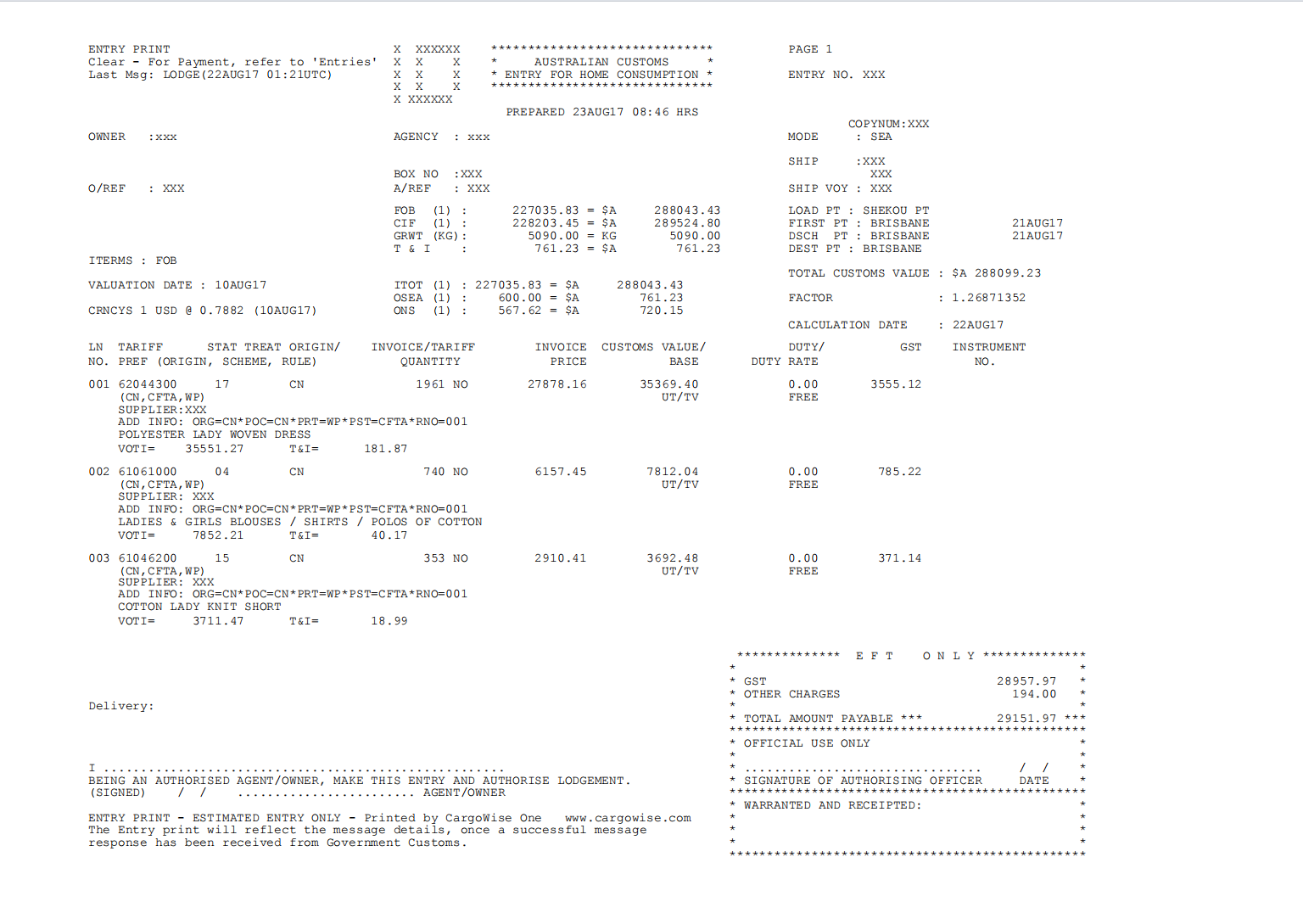

A ƙasa akwai misalin daftarin haraji/gst na Australiya wanda kwastan AU ya bayar:

Koyaya, idan ƙimar kayanku ta ƙasa da AUD1000, zaku iya neman aikin AU/gst sifili. Kwastam na Ostiraliya ba zai ba da daftari ba

For more information pls visit our website www.dakaintltransport.com or email us at robert_he@dakaintl.cn or telephone/wechat/whatsapp us at +86 15018521480

KASHIN HIDIMAR SAUKI

-

Waya

-

Imel

-

Whatsapp

-

WeChat

-

Sama